Are you ready to embark on an entrepreneurial journey in Wisconsin? Consider forming a limited liability company (LLC) to protect your personal assets, streamline taxes, and set the stage for your business growth. Creating an LLC in Wisconsin is a relatively straightforward process, and with this comprehensive guide, you’ll be well-equipped to navigate each step with confidence.

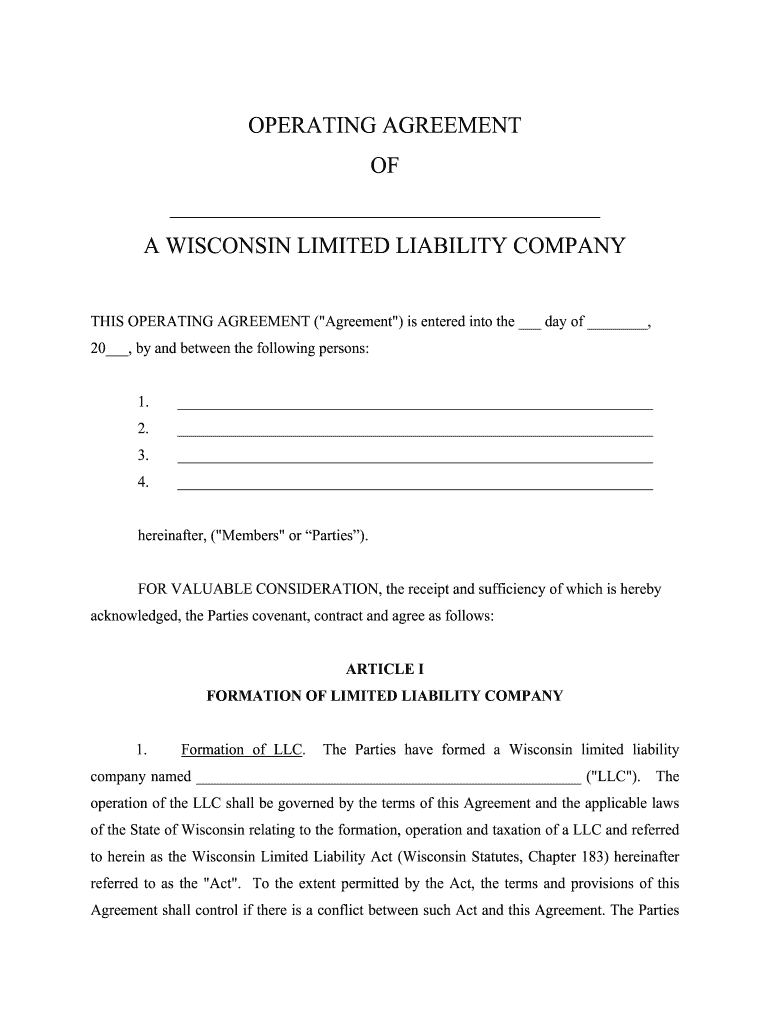

Featured Image

Source www.signnow.com

Step 1: Choose a Business Name

Your LLC’s name should be distinctive, memorable, and relevant to your business activities. Conduct a thorough search to ensure that the name you choose isn’t already taken by another LLC or corporation in Wisconsin. You can check the availability of your desired name through the Wisconsin Department of Financial Institutions (DFI) website.

Tips for Choosing a Business Name:

- Use keywords that describe your business or industry.

- Consider your target audience and their perception of the name.

- Avoid using generic or overly common names.

- Make it concise and easy to pronounce.

- Ensure it’s not infringing on any trademarks or copyrights.

Step 2: Designate a Registered Agent

Every LLC in Wisconsin must have a registered agent who is responsible for receiving official documents and legal notices on behalf of the company. The registered agent must have a physical address in Wisconsin and be available during normal business hours. You can appoint yourself as the registered agent or hire a professional service like a lawyer or registered agent company.

Benefits of Having a Registered Agent:

- Ensures that your LLC stays compliant with legal requirements.

- Protects your privacy by keeping your personal address confidential.

- Provides a point of contact for official communications and legal proceedings.

Step 3: File Articles of Organization

The Articles of Organization are the legal document that officially establishes your LLC in Wisconsin. They include essential information about your LLC, such as:

- The name of your LLC

- The address of your registered office

- The names and addresses of your registered agent and organizers

- The purpose of your LLC

- The duration of your LLC (if applicable)

You can file your Articles of Organization online or by mail with the Wisconsin DFI. The filing fee is $150.

Step 4: Create an Operating Agreement

An Operating Agreement is an internal document that governs the operation and management of your LLC. It outlines the rights and responsibilities of the LLC’s members, including:

- How decisions will be made

- How profits and losses will be distributed

- The procedures for admitting and removing members

While an Operating Agreement is not required by Wisconsin law, it is highly recommended to have one in place to avoid disputes and protect your interests.

Step 5: Obtain an Employer Identification Number (EIN)

If your LLC has employees or plans to have employees in the future, you’ll need to obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). You can apply for an EIN online or by mail. It’s free to apply for an EIN.

Step 6: Open a Business Bank Account

Opening a business bank account is essential for keeping your personal and business finances separate. Choose a bank that offers services tailored to small businesses, such as low fees, online banking, and merchant services.

Benefits of Having a Business Bank Account:

- Protects your personal assets from business liabilities.

- Makes it easier to track your business income and expenses.

- Helps you establish a positive credit history for your LLC.

Step 7: Comply with State and Federal Regulations

Once your LLC is established, it’s important to comply with ongoing legal requirements, such as:

- Filing annual reports with the Wisconsin DFI

- Paying taxes to the Wisconsin Department of Revenue and the IRS

- Obtaining necessary licenses and permits

- Maintaining liability insurance to protect your business and assets

Conclusion

Creating an LLC in Wisconsin is an exciting step towards achieving your business goals. By following these steps and staying compliant with legal requirements, you can establish a solid foundation for your LLC and set yourself up for success. Remember, if you encounter any challenges or have additional questions along the way, don’t hesitate to consult with an attorney or professional advisor to ensure that your LLC is operating in the best possible manner.

Additional Resources:

- Wisconsin Department of Financial Institutions

- Internal Revenue Service

- Small Business Administration

FAQ about How to Create an LLC in Wisconsin

What are the steps to form an LLC in Wisconsin?

Answer:

- Choose a name for your LLC and ensure it is available.

- Designate a registered agent.

- File Articles of Organization with the Wisconsin Department of Financial Institutions.

- Obtain an Employer Identification Number (EIN) from the IRS.

- Create an Operating Agreement.

What is the filing fee for an LLC in Wisconsin?

Answer:

The filing fee for Articles of Organization is $130.

Is a registered agent required for an LLC in Wisconsin?

Answer:

Yes, every LLC must have a registered agent in Wisconsin.

What is the role of a registered agent?

Answer:

A registered agent receives official notices, legal documents, and tax forms on behalf of the LLC.

What is an Operating Agreement?

Answer:

An Operating Agreement is an internal document that outlines the ownership structure, management, and operating procedures of the LLC.

Is an Operating Agreement required for an LLC in Wisconsin?

Answer:

An Operating Agreement is not required by law in Wisconsin but strongly recommended.

Does an LLC need to file annual reports in Wisconsin?

Answer:

Yes, LLCs must file an annual report with the Wisconsin Department of Financial Institutions by March 1st of each year.

What are the tax obligations for LLCs in Wisconsin?

Answer:

LLCs are considered pass-through entities for tax purposes, meaning profits and losses pass through to the individual members. LLCs are required to file a Wisconsin Form 1 with the Wisconsin Department of Revenue.

How do I dissolve an LLC in Wisconsin?

Answer:

To dissolve an LLC in Wisconsin, you must file Articles of Dissolution with the Wisconsin Department of Financial Institutions.

Where can I get more information about forming an LLC in Wisconsin?

Answer:

You can visit the website of the Wisconsin Department of Financial Institutions (https://dfi.wisconsin.gov/) or contact the department directly for assistance.