💰 How to Calculate Car Depreciation: Unlocking the Secrets of Value Loss 💰

Calculating car depreciation is like navigating a financial labyrinth. But fear not, we’re here to guide you with a clear and friendly approach! 😊 Whether you’re a seasoned car enthusiast or embarking on your first automotive venture, this comprehensive guide will empower you to understand and calculate car depreciation like a pro.

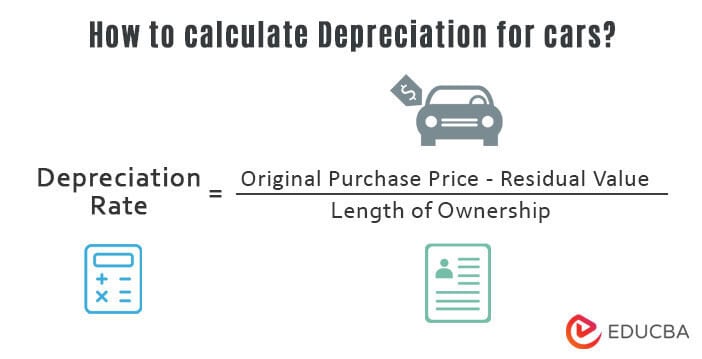

Source www.educba.com

🧮 Understanding Car Depreciation

Car depreciation refers to the decrease in value that a vehicle experiences over time due to various factors, such as usage, age, and technological advancements. Depreciation is an unavoidable aspect of car ownership, but it’s crucial to understand its implications on your financial decisions. By calculating depreciation, you can make informed choices about purchasing, selling, and maintaining your vehicle.

🔢 Methods of Calculating Car Depreciation

There are several methods you can use to calculate car depreciation. Let’s explore the most common:

1. Straight-Line Depreciation

This is the simplest method, where you assume a constant rate of depreciation over the vehicle’s useful life. To calculate:

- Determine the car’s purchase price

- Estimate the estimated salvage value at the end of its useful life

- Estimate the useful life in years or miles

Depreciation Expense = (Purchase Price - Salvage Value) / Useful Life

2. Double-Declining Balance Method

This method accelerates depreciation in the early years of ownership. Calculator:

Depreciation Expense = (2 * Straight-Line Depreciation Rate) * Book Value

3. Units-of-Production Method

This method is based on using the actual usage of the vehicle rather than its age:

Depreciation Expense = (Actual Usage / Estimated Total Usage) * Purchase Price

📊 Factors Affecting Car Depreciation

Several factors influence the rate of car depreciation:

- Age: As a general rule, cars depreciate more rapidly in the first few years of ownership.

- Mileage: The higher the mileage, the greater the depreciation.

- Make and Model: Luxury brands and popular models tend to depreciate at a slower rate than lesser-known brands.

- Condition: Well-maintained cars with clean histories depreciate less.

- Economic Conditions: Changes in the economy and market demand can impact depreciation rates.

🛠️ Strategies to Minimize Depreciation

While depreciation is inevitable, here are some tips to minimize its impact:

- Consider purchasing a gently used vehicle with lower mileage.

- Opt for a popular and reliable make and model with a strong resale value.

- Maintain your car regularly to keep it in good condition.

- Don’t drive excessively or in harsh conditions.

📈 Tracking Car Depreciation

Tracking your car’s depreciation can help you make informed financial decisions. Utilize online depreciation calculators or mobile apps to estimate your vehicle’s current value. Additionally, you can track your expenses and mileage to calculate your actual depreciation.

🤔 Why Should You Care About Car Depreciation?

Car depreciation is relevant for several reasons:

- Resale Value: Understanding depreciation helps you accurately estimate the potential resale value of your car.

- Loan Payments: Lenders use depreciation to determine the value of your car as collateral for a loan.

- Taxes: Depreciation can affect your tax liability if you use your car for business purposes.

🤝 Comparison Table

| Method | Formula | Advantages | Disadvantages |

|---|---|---|---|

| Straight-Line Depreciation | (Purchase Price - Salvage Value) / Useful Life |

Simple and easy to calculate | Assumes a constant depreciation rate |

| Double-Declining Balance Method | (2 * Straight-Line Depreciation Rate) * Book Value |

Accelerates depreciation in the early years | Can result in higher depreciation deductions in the short term |

| Units-of-Production Method | (Actual Usage / Estimated Total Usage) * Purchase Price |

More accurate representation of usage-based depreciation | Requires accurate tracking of vehicle usage |

😊 Conclusion

Calculating car depreciation is a valuable skill that can empower you to make informed decisions about your finances. By understanding the different methods and factors involved, you can minimize depreciation and maximize the value of your vehicle. 😊

For more car-related wisdom, be sure to check out our other articles on maintenance, fuel efficiency, and the latest automotive trends.

FAQ about Car Depreciation

### What is car depreciation?

- When you buy a car, it loses value over time due to use, wear and tear, and technological advancements. This loss in value is called depreciation.

### Why is it important to calculate car depreciation?

- Knowing how much your car depreciates helps you budget for expenses like repairs, insurance, and resale value.

### How do I calculate car depreciation using the P-A-S formula?

- P = Purchase Price

- A = Accumulated Mileage

- S = Salvage Value

- Depreciation = P – ((P – S) x (A / Useful Life))

### What is the useful life of a car?

- The useful life of a car is typically 10-15 years or 150,000-200,000 miles. This varies depending on the make, model, and maintenance.

### What is the salvage value of a car?

- The salvage value is the estimated worth of your car at the end of its useful life. It can be found online or through Kelley Blue Book.

### How can I minimize car depreciation?

- Buy a car that holds its value well.

- Keep your car in good condition with regular maintenance.

- Drive less or avoid driving in hazardous conditions.

- Sell your car before it reaches the middle of its useful life.

### How can I increase car depreciation for tax purposes?

- Use the IRS Section 179 deduction to write off a portion of the car’s cost in the year it was purchased.

- Take the standard mileage deduction for business-related use.

### What is the straight-line depreciation method?

- This method assumes an even loss of value over the useful life of the car.

- Depreciation = (Purchase Price – Salvage Value) / Useful Life

### What is the double-declining balance method?

- This method allows for more depreciation in the early years of the car’s life.

- Depreciation = (2 * Straight-Line Depreciation Rate) * Book Value

### What method should I use to calculate car depreciation?

- The P-A-S formula is most accurate.

- The straight-line method is simple and widely used.

- The double-declining balance method provides more depreciation in the early years. Choose the method that best suits your needs.